|

| HOME | COLLECTION AGENCY | CONTACT US |

Student Account Collections for Schools & CollegesUnpaid tuition and student balances aren’t “small admin issues.” They quietly drain your budget. Every month a balance sits unresolved, your team loses time to follow-ups, your forecasting gets messy, and your ability to fund programs gets squeezed. You need a collections partner who can be firm, professional, and reputation-safe—so money comes in without the community blowback.

Schools and colleges don’t “sell products.” You serve students and families. That’s why collections in education must be firm, respectful, and documented—so your institution gets paid, without damaging community trust. We help recover past-due balances from items like tuition, activity fees, meal plans, unreturned equipment, and other student-related charges. The goal is simple: get you paid while keeping your school’s reputation intact. Contact us for a complimentary consultation. Our Priorities

What People Say About Our ApproachReal Reviews

⭐ I have had wonderful interactions with Ann! She has worked so well with me and getting my debts caught up and collected. I couldn't of asked for a better rep to work with to finally catch up my student loans. She definitely seems to care about her work, and getting people caught up on their debts owed. Was super considerate when I reached out for help when I was struggling to stay on top of my case. Super grateful to have worked with her on my situation! - Mark Harsh

⭐ I had overlooked a school bill and received a call this morning from Nathan. He was really lovely to talk to and had EXCELLENT customer service skills and the issue was resolved quickly. Thank you very much. - Miriam ⭐ I recently had to deal with them due to a rental instrument for my sons band class. Because of this pandemic we were unable to retrieve the instrument from the school. The account was referred to collections with no notice. While working this out with lo I’m they representative was very helpful and they helped us correct the situation quickly. I am very appreciative to them in that regard. Working with a collection company can be very difficult and many agencies are not very friendly, this is not the case with them. - David Calderon

Two Quick Case StudiesCase Study 1: K–12 School — Fees, Devices, and “Small Balances” That Add Up

Situation: A K–12 school had a growing pile of unpaid cafeteria balances, activity fees, and unreturned Chromebook charges. The staff didn’t want aggressive calls, and they didn’t have time to chase parents daily. What we did: We started with a soft, compliance-friendly outreach to verify contacts, send clear statements, and offer simple payment options. Accounts that didn’t respond moved into a stronger phase—still respectful, but more direct. Result: The school cleaned up older balances, reduced office time spent on follow-ups, and avoided the “angry parent Facebook post” problem because outreach stayed professional and transparent. Case Study 2: College — Tuition Installment Plans That Stalled Mid-Semester

Situation: A private college had multiple students on installment plans who stopped paying mid-term. The finance office needed recoveries—but also wanted to protect future enrollment and alumni sentiment. What we did: We verified documentation (tuition agreement, payment plan terms, communications), then contacted students with a solutions-first tone: clarify the balance, offer realistic arrangements, and document every step. Only clear non-responders escalated. Result: The college recovered funds faster, kept internal staff out of uncomfortable conversations, and maintained a reputation-safe approach by escalating only when necessary. Why Schools Choose CA-USA

Common Reasons Student Balances Go Past Due

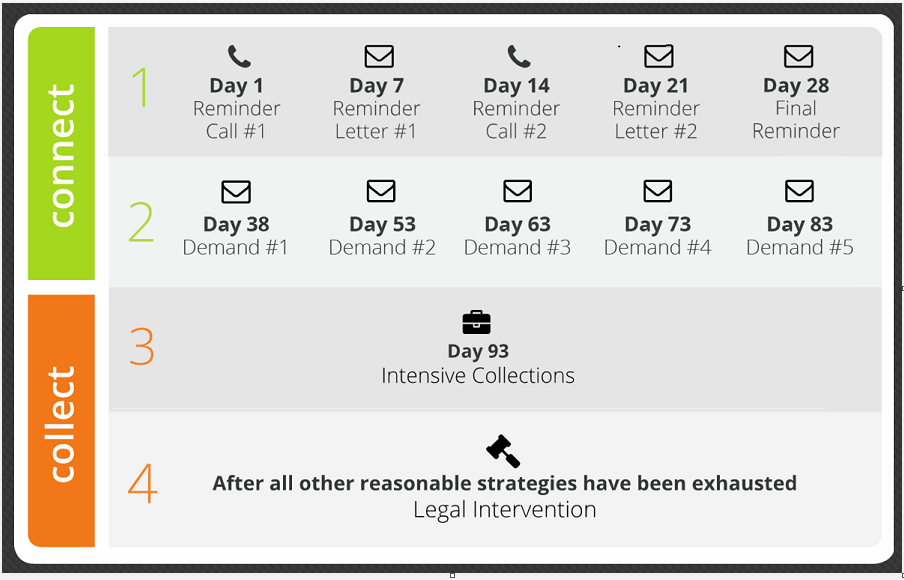

How the 4-Phase Process WorksYour school’s collection strategy should have “graduated intensity.” We typically use four phases so you can start light and escalate only if needed.

Connect Phase (Step 1 / Step 2): Low-cost outreach designed to encourage payment without commission. Many schools use this first because it’s diplomatic and fast. Collect Phase (Step 3): Stronger third-party collections when earlier outreach doesn’t resolve the balance. Legal Phase (Step 4): Last-resort escalation (only if the school wants to pursue legal recovery). Quick FAQWill this hurt our enrollment?It shouldn’t. The key is a professional tone, clear documentation, and using a phased approach so families have fair opportunities to resolve balances. What do you need from us to start?Basic account details, backup documentation (invoice/statement/fee policy), and the best contact information you have. We handle the outreach and reporting. Can we pause or stop the process?Yes. If a family calls your office and you want to handle it internally, you can pause the account and route it the way you prefer. Contact UsContact us | 1-844-666-7890 | support@CollectionAgencyUsa.com We have been assisting thousands of businesses & medical practices across the country. |

|

COPYRIGHT: BIOTECHARTICLES.COM | ALL INFORMATION ON THIS WEBSITE IS FOR GENERAL INFORMATION ONLY AND IS NOT A PROFESSIONAL OR EXPERTS ADVICE. WE DO NOT OWN ANY RESPONSIBILITY FOR CORRECTNESS OR AUTHENTICITY OF THE INFORMATION PRESENTED ON THIS WEBSITE, OR ANY LOSS OR INJURY RESULTING FROM IT Old Site. |